The internet is full of canine temptations, and it’s really easy to get lost down the rabbit hole that is social media. We move at the speed of light, and you’ve got less than five seconds — the attention span of a goldfish — to capture someone’s attention online. Instagram visuals stop people in their tracks, YouTube adds an actionable component and blogs bring it home by solving problems.

If you’re a creative dog owner who wants to get involved in the dog influencer game, here are some insider secrets to social media success along with bonus tips from pros who are leading the pack.

Pick a lane and stay in it.

Don’t try to be on every social platform because “everyone else is doing it.”

Pets are enjoying a level of social media fame previously reserved for human celebrities, and starting an Instagram account for your pet is easy. Using strategy, planning, and social media skills, your pet could be the next big thing.

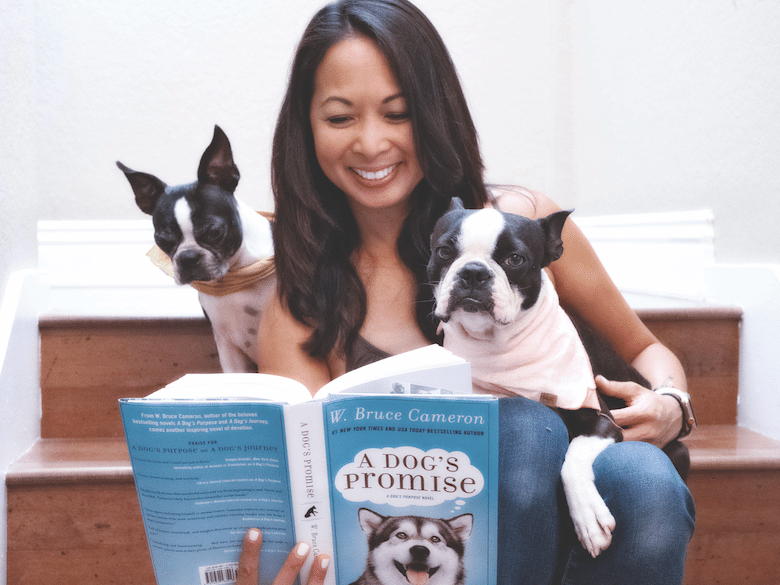

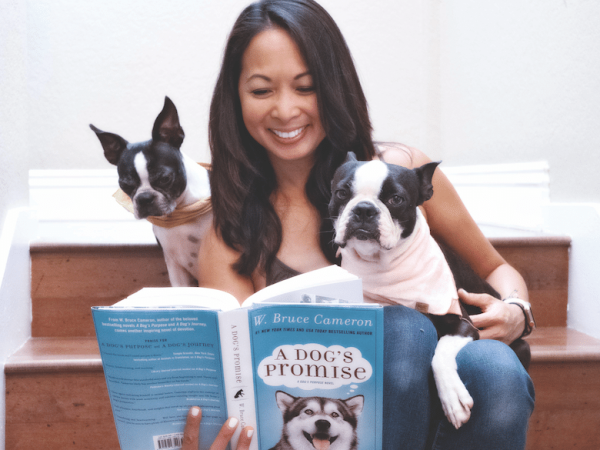

Hannah Zulueta runs the popular Instagram account @MaggieLovesOrbit and its accompanying blog. Her best tip for evergreen success is to be real and authentic. She imagines having a conversation with her grandma, a nephew, a significant other, or a best friend.

“For example,” she muses, “They ask, ‘How was your day?’ To which I respond, ‘You’ll never believe what happened today … we went to the beach, and the girls ate a crab. I let them eat it. And then later on OMG I learned it might be bad. But then I realized the dime-sized crab they ate wasn’t going to hurt them, so they survived. They had dinner. All is good.’”

Avoid This: Content that appears too staged or a copycat version of someone else’s account. Hannah says that pets are the purest side of humanity, and online content should reflect that.

Pay close attention to the problems of dog owners.

Answer their questions in a succinct way that incorporates SEO (search engine optimization) rules, and you’re on your way to pet blogging success.

Jennifer Costello is the brainchild behind MyBrownNewfies.com, which began as a labor of love for her dogs Sherman and Leroy. She makes a living as a pet blogger and pays close attention to the questions her readers ask on social media.

“I see what challenges they face with their Newfs and write a blog post tailored to that challenge or question,” Jennifer shares. “I share that post to all my social media sites, send it to my email subscribers, and post it in my Newfoundland Dog Support Community Facebook group.”

Avoid This: Bashing brands or other people online. A digital trail follows everyone even if you delete the content after publishing. People take screenshots, and digital words live forever. Write as if your words are going to appear on a billboard in Times Square. Rants are fine for chats with friends, but keep it real when it comes to online content.

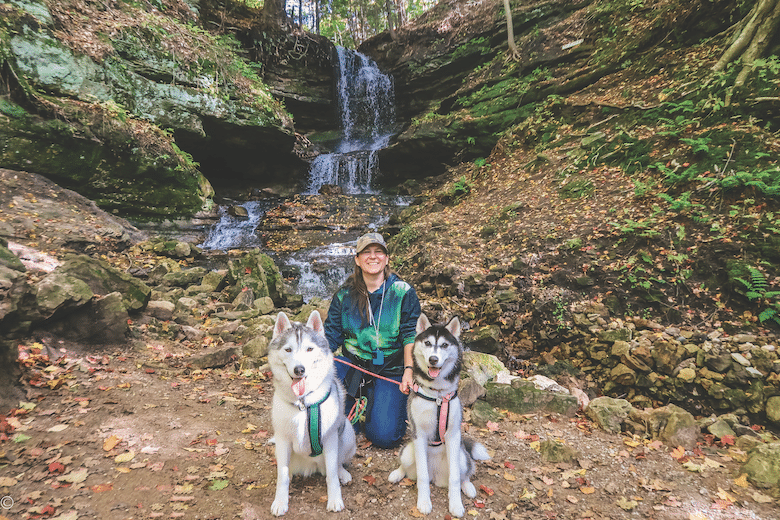

Gone to the Snow Dogs. You can also follow her @gonetothesnowdogs.

Teach or entertain but avoid making it all about you

People visit YouTube to learn or to be entertained. You can learn to do just about anything on YouTube, including tips to help dog owners.

Jessica Hatch runs the wildly successful YouTube channel, Gone to the Snow Dogs. Her success lies in having a passion and creating content around that passion.

“Regular uploads matter, whether daily, weekly, or monthly,” Jessica says. “Be consistent so people will know when to expect content from you.”

Her YouTube channel success didn’t happen overnight, and she recommends not forcing content in order to avoid burnout.

“Nail down your goals and channel mission and create content around those things,” Jessica recommends.

avoid this: “Me, me, me” syndrome. Become a storyteller, not a story teller: A successful social media post or YouTube post includes a captivating image/video + engaging text + proper timing + hashtag strategy + engagement + rinse and repeat. You need not be Shakespeare, but you need to have a good grasp of how to tell a story to your audience.

Decide on love, money, or both

In Pet Blogging for Love & Money, the book I co-authored with Maggie Marton, we stress the importance of establishing goals before starting any social media or blogging process.

Goals are as unique as mixed breeds, and no two are alike. Here are a handful of imaginary blog goals for example:

- Double your email list

- Sell 500 copies of an e-book

- Land two brand partnerships

- Start a TikTok channel

- Increase visitors/followers by 20% in six months’ time.

Avoid This: Trying to do it alone. There is strength in numbers and power in the community. For example, the right Facebook groups can be one of the best investments of time you’ll make. If you are a veteran to blogging, reassessing your present Facebook groups and their importance is something you should do at least once or twice a year.

Network, network, network

As a long-time successful dog blogger, in-person networking and making connections have been a key staple to my success. I meet someone at a conference, we talk and develop a relationship, and perhaps move forward and work together. I stop at a booth at a pet industry trade show, exchange business cards (yes, that’s still a thing), follow up, and later we work together. I develop writing relationships with published authors at Dog Writers Association of America events. I later pitch to editors. See how it works?

Online success is a lot like dog training. It takes consistency, loyalty, patience, time, and commitment, but the rewards are worth the wait. Most dogs want nothing more than to please us, their humans, and social media success is similar. Pet blogging and social media growth is a marathon, not a sprint, so keep that in mind as you start or continue your path to e-success.

Featured photograph credit: Hannah Zulueta runs the Instagram account @MaggieLovesOrbit about the adventures of her too-cute Boston Terriers. Check out her accompanying blog at maggielovesorbit.com.